Did you know that you can make a complaint if your life or health insurance company denies your claim?

Before you submit your complaint to us at the OmbudService for Life and Health Insurance (OLHI), you first need to go through your insurance company’s internal complaint process.

Can I go directly to OLHI with my denied insurance claim?

OLHI can’t review a complaint about a denied claim if you haven’t gone through your insurer’s internal process.

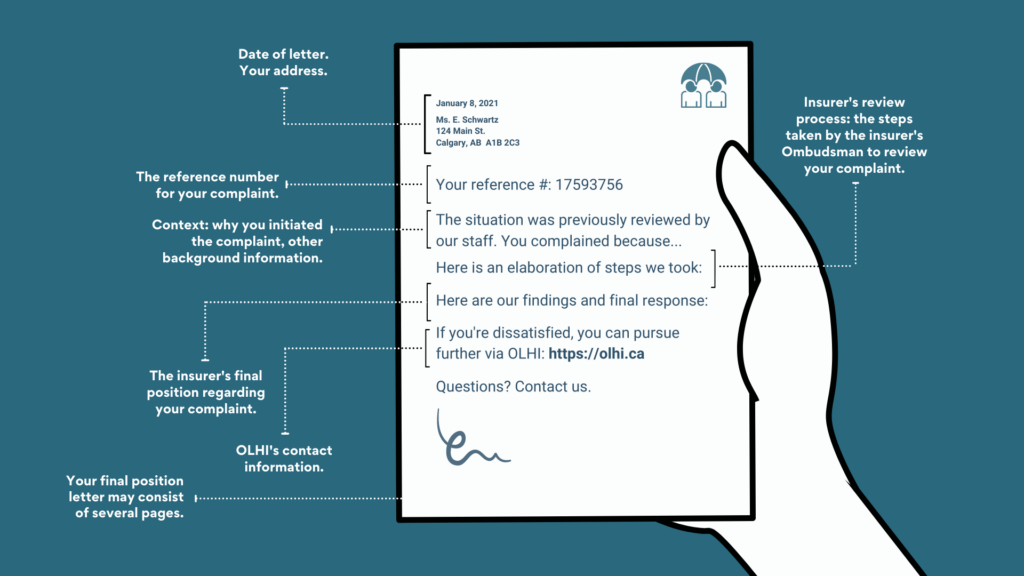

We’ll know that you completed this process if you have a “final position letter”—it’s one of the first things we’ll ask for after you submit a complaint to OLHI.

How to submit a complaint to your life or health insurance company

1. Appeal your denied claim.

If your life or health insurance claim gets denied, a Case Manager will send you a claim denial letter. Each submitted claim gets assigned to a Case Manager, whose job is to review these claims to see if they are payable—or not.

A claim denial letter will provide step-by-step instructions on how to appeal your denied claim. You’ll likely need to provide additional details (in writing) to your insurer to clarify the context of your claim.

If you receive a second claim denial letter, now you have the grounds to file a complaint.

2. Submit your life or health insurance complaint to a Complaint Officer.

Once you’ve unsuccessfully appealed your denied claim, you can escalate your situation to a Complaint Officer at your insurance company.

A Complaint Officer has the authority to make a final decision about your complaint.

Before sending your complaint, contact your insurance company to determine to whom you should address your complaint and what documentation you need to attach.

OLHI has a Consumer Complaint Officer Listing tool that allows you to quickly find the contact information for your insurance company’s Complaints Officer. (If you don’t see your insurance company on this list, it means they aren’t a member company of OLHI.)

3. Submit your life or health insurance complaint to a Complaint Officer.

Once you complete your insurance company’s complaint process, you will receive a “final position letter.” If you don’t receive a final position letter, ask for one from the Complaint Officer.

4. Contact OLHI if you haven’t heard from your Complaint Officer in 90 days or more.

If your insurer takes longer than 90 days to reach a decision, ask OLHI to contact your company to inquire about the status of your complaint.

What to do if you’re unhappy with your insurer’s final decision on your complaint

Followed all the steps above, but you’re still dissatisfied with your insurer’s final position? You can now submit a complaint to OLHI. If your case is reviewable and has merit, we can provide a free, independent, and impartial review.

OLHI – Free, impartial help with your life & health insurance complaints

OLHI – Free, impartial help with your life & health insurance complaints