Our Ombudsman is head of the OmbudService for Life and Health Insurance (OLHI). OLHI offers an alternative dispute resolution public service that is free, bilingual, independent and impartial to Canadians with life and health insurance.

Sounds great so far, right? But what is an ombudsman or an ombudservice? How does alternative dispute resolution (ADR) work?

More importantly, how can an ombudsman or ADR help you?

Ombudsman: A brief history

More than 200 years ago, Sweden appointed the first Ombudsman to resolve complex problems when the King was away. The term “ombudsman” originates from “ombuds” (umboðsmaðr), which means “proxy agent” or “representative” in Old Norse.

Today, there are ombudservice offices for governments, organizations, and financial institutions across the globe.

What does an Ombudsman do?

An ombudsman can review complaints from the public about government, organizations, or financial institutions. An ombudsman’s goal is to help both sides come to a resolution via mutual agreement.

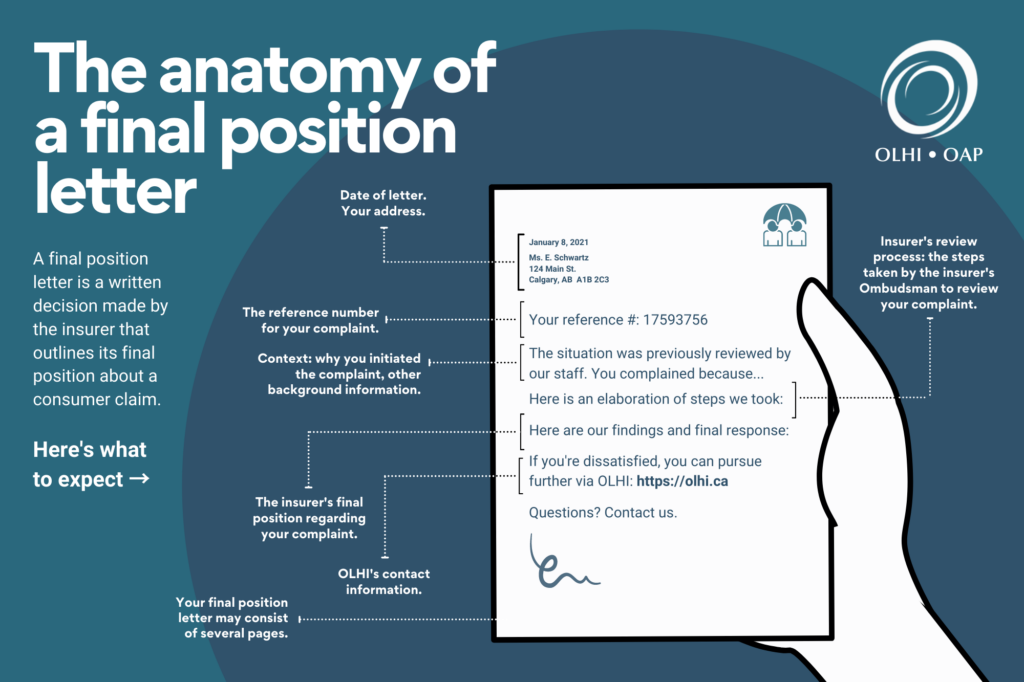

Canadian life and health insurance consumers can submit a complaint to us if they feel dissatisfied with their insurer’s final position on a policy.

If your complaint is reviewable, we can review your policy outcome. If it has merit, OLHI can offer a non-binding recommendation to your insurance company.

According to the International Network of Financial Services Ombudsman Schemes, the hallmark of an ombudsman is a “free, independent, impartial, fair, timely, efficient and informal alternative dispute resolution process.”

Alternative Dispute Resolution in a nutshell

At its core, Alternative Dispute Resolution (ADR) is about finding fair resolutions to disputes outside the courts.

In other words, say you have a complaint with your life or health insurance provider, ADR may help solve your problem without expensive, lengthy, and adversarial litigation.

Benefits of Alternative Dispute Resolution (ADR)

Consider the benefits of ADR; you may thank yourself later. Alternative Dispute Resolution is:

- Confidential—ombudservices have strict privacy policies and cannot share your information with anyone

- Far more flexible than court proceedings

- More cost-effective than litigation—it’s a free service to the public

- Can offer resolution faster than litigation

- Applicable over multiple jurisdictions (e.g., provinces, countries) at once, thereby evading a substantial time commitment to several lawsuits

How can an Ombudsman help me?

The OmbudService for Life and Health Insurance (OLHI) provides an impartial, independent, bilingual, and free ADR public service to the 29 million Canadians with life and health insurance.

Our public service can also guide consumers through the complaints process and answer their questions. We can also help them find lost policies or policies of deceased loved ones.

OLHI – Free, impartial help with your life & health insurance complaints

OLHI – Free, impartial help with your life & health insurance complaints